It’s often said that starting to save or invest early is extremely important, but why is this? By starting early you not only have more time to contribute and grow your nest egg, but you can also harness the power of compounding returns to really accelerate your saving. Of course, as we’ve seen recently, the value of investments can go up or down, but if you have a long-term timeframe, your investment should see the benefits of compounding returns.

What are compounding returns?

Compounding of investment returns is when you earn returns both on the money you’ve invested and on your investment returns (compared with “simple returns” where you only make returns on the amount you have invested). By investing in KiwiSaver or a managed fund your returns will, in most cases, compound.

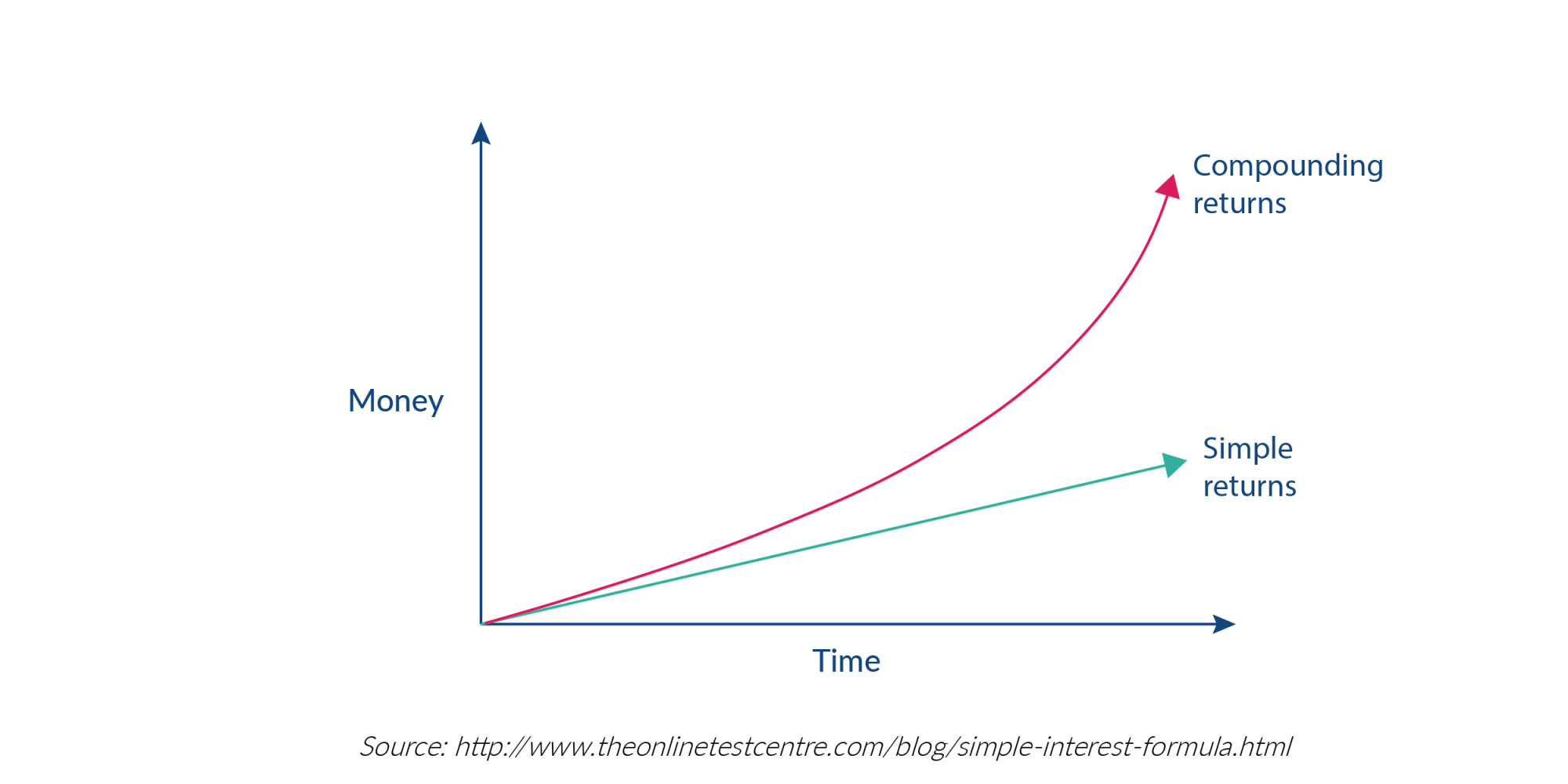

You can see from the graph below, compounding returns help your investment grow exponentially, with the pink line showing compound returns and the green line showing simple returns.

How compounding returns work

Here’s an example of how compounding returns can accelerate your saving. Let’s say an investment fund returns 5% each year and you make an initial investment of $100 and then don’t make any further contributions. By the end of the first year, the balance in your account will have grown to $105 as you’ll have earned $5 in returns. By the end of the second year, you’ll earn $5.25 in returns from your $105 to have a balance of $110.25. By the end of the third year, you will have earned around $5.50 in returns giving you a balance of $115.80.

This pattern continues the longer you leave this money in your account. By the end of the tenth year, your account will have a balance of $162.90, but if you left your money invested for another 10 years, the balance of your account will have grown to $265.30.

You can see from this example, the longer you leave this money in the account, the larger your balance can grow as you’re able to boost your savings by continuing to earn returns on top of your returns. Of course, if you keep contributing a bit more each year, you can ramp up your savings even more!

Starting to invest earlier gives compounding returns time to work their magic

Starting to invest early is important not only because you end up putting away more money over time, but also because you have longer to take advantage of compounding returns.

You can see just how much of a difference you could make by starting to invest 10 years earlier.

Let’s say you invest $100 each month for 30 years – compared to the same amount each month for 20 years. Again, for this example we’ve assumed a rate of return of 5% per annum.

If you started now, in 30 years your investment would be worth just over $80,000 (including your investment returns of over $40,000). However, if you started investing $100 a month in 10 years’ time, after 20 years of investing your savings would only be worth about $40,000 (with your investment returns amounting to a much smaller figure of around $16,000).

So you can see how investing 10 years earlier could really boost your savings – using the above example you would double your total savings!

By investing in a KiwiSaver or managed funds account your returns will compound, and by starting your investing journey early you can really harness the power of compounding.